Borisov Lachezar

Ph.D Student

High School of Insurance and Finance

Sofia, Bulgaria

BANK EFFICIENCY CHANGE AS A RESULT OF THE LAST BANK CONCENTRATION IN BULGARIA

Restructuring of the banking system in a number of countries became one of the most important issues, especially after the negative impact of the global financial crisis in 2007-2008 on the financial intermediaries. The process of banks restructuring actually aimed to improve the efficiency and profitability of the banks. Thus, the objective of the study is to analyse how the bank efficiency changes after the mergers and acquisitions in Bulgaria, based on the latest restructuring of the Bulgarian banking system performed on March 9, 2016. It concerns the acquisition of Alfa bank Bulgaria by Eurobank Bulgaria, which took all rights, obligations and factual relations of the branch of Alfa Bank, operating in Bulgaria. The study uses the so-called micro approach on assessment of the financial stature of banking system [1].

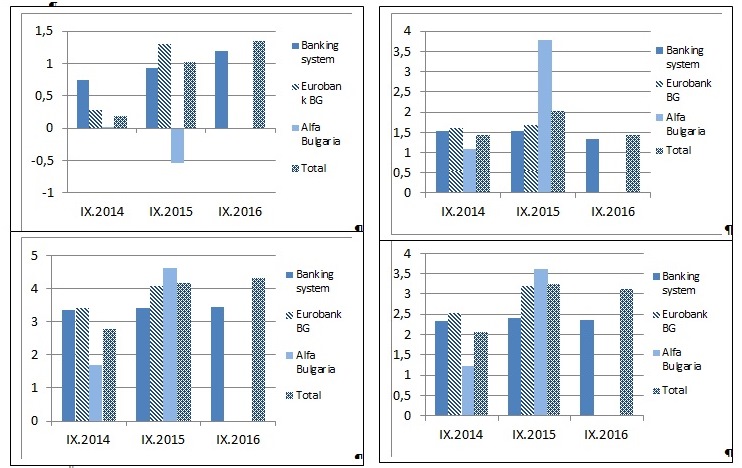

For the purpose of measurement of bank efficiency change the study uses a number of traditional indicators in particular the ROA, administrative costs/assets (AC/A), net financial and operational revenues/assets (NFOR/A) and net income margin (NIM). In the literature we could find not only these traditional indicators, but also non-traditional indicators, such as the nonparametric and parametric approaches, based on production frontiers [2]. By using the indicators [1],[3] we will estimate how the indicators change after the concentration. In order to make in depth analysis we are comparing the same indicators for the whole banking system and also for the both banks (before and after the concentration) in order to take into account the direction of the overall dynamics of banking sector development and effects after the concentration. For the purpose of the calculation of the indicators’ value the official financial statements, published by the Bulgarian National Bank, are used. The results of the analyses are presented in Figure 1.

Figure 1. ROA (up, left), AC/A (up right), NFOR/A (down left), NIM (down right)

Based on the calculated data we found that:

- As a result of the concentration there is an increase of return on assets, as compared to the levels of the indicator for banks, participating in the concentration and in terms of the total score for both banks. The merger has a positive impact on the deviation from the average indicator for the banking system.

- After the merger of the Alfa bank – branch Bulgaria with Eurobank Bulgaria there is a clear decline of the indicator administrative costs/assets as compared to the total value before the operation. The merger has positive impact on the deviation from the average indicator for the banking system as a whole.

- There is an increase of the indicator NFOR/A as compared to the total value of the indicator for both banks before the merger. Moreover, there is also a positive trend in terms of its deviation compared to the average level of the indicator for the banking system.

- There is no impact on net interest margin indicator. The indicator remained relatively unchanged for the both banks before and after the merger, as well as relatively unchanged in respect to its deviation from the average indicator for the banking system. The reason for that is the general trend in recent years to decrease in interest rates on deposits and loans in the banking system, which closes the gap between them.

By using the traditional measures for the bank efficiency and profitability we have proved that as a result of the merger of Alfa Bank – branch Bulgaria and Eurobank Bulgaria there was an improvement of profitability indicators and efficiency of banks after the concentration. We have to note that the improvement in indicators of the merged bank is not due to a change in the overall situation in the banking sector as indicators improve their value as compared to the average value of the same indicator for the total banking system. The empirical analysis of the efficiency and profitability of the banks after merger confirmed the general economic theory for synergic effect, reduction of average costs and economies of scale in horizontal mergers[1] [4]. Following this effects new mergers and acquisitions in Bulgarian bank systems can be expected.

References

- Bojinov, B. (2013). Analysis of the development of the Bulgarian banking system (2007 – 2012), Academy of Economics “D. Tsenov” Svishtov. [in Bulgarian]

- Mihaylova, G. (2014) Bank efficiency in Bulgaria, international financial crisis and European debt crisis, Economic and social alternatives, N 3. [in Bulgarian]

- Agresti, A., Patrizia Baundino, P. Polini, P. (2008) The ECB and IMF Indicators for the Macro-Prudential Analysis of the Banking Sector: A Comparison of Two Approaches, ECB.

- Frohlich, C, and Kavan , B An examination of bank merger activity: a strategic framework content analysis, University of North Florida, Available at : http://www.unf.edu/

[1] Frohlich, C, and Kavan , B An examination of bank merger activity: a strategic framework content analysis, University of North Florida, Available at: http://www.unf.edu/

|