Mihaylova-Borisova Gergana

Ph.D., Associate Professor

University of National and World Economy

Sofia, Bulgaria

TRADITIONAL VERSUS NON-TRADITIONAL APPROACHES FOR BANK EFFICIENCY MEASUREMENT IN BULGARIA

Banks are undoubtedly the most important financial intermediaries within the Bulgarian economy. They accumulate considerable resources through attracting deposits and providing credits to all sectors that experience the need for funding their investment projects[1]. Due to their intermediation function banks can cause increase in aggregate demand, higher production and economic growth. In terms of the global financial crisis this important role of the banks has weakened due to the significant slowdown of credit activity in Bulgaria. Banks are now beginning to be more cautious in granting new loans because of worsened credit portfolios. According to Evgeni Raykov banking system is over-regulated, closed and risk-averse and this results in missed short-term lending market for banks in Bulgaria for approximately 15-20 billion leva [1]. The increase in bad loans directly restricts the process of lending, increases the cost of credit and makes the access to financing difficult, causing the increase in intercompany indebtedness. Slowing credit growth actually affects the efficiency and profitability of banks.

This study focuses on analyzing to what extent the banks affect the economic growth in Bulgaria by paying attention to accurate unconventional measures for effectiveness that cover more complete bank’s intermediary role in the economy.

The study uses two types of indicators - traditional accounting profitability indicators based on return on assets and return on equity and nontraditional approach, non-parametric method to measure the effectiveness, in particularly "Data Envelopment Analysis" (DEA). When using non-traditional indicators based on DEA, banks are considered to be production units that have several inputs and outputs. This allows to rely on a more complex indicator of the effectiveness of banks (technical efficiency) encompassing both passive and active operations of banks [2]. In economic literature one of the most commonly used approach is the one of mediation (Andries, Cocris [2] and Sufrin [3]) that defines three types of inputs - tangible and intangible assets, deposits and employed[3] and two outputs - securities and loans. To calculate the average rates of effectiveness for the banking system we use the program DEAP 2.1.

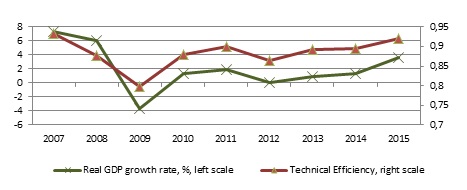

Tracing the dynamics of real GDP in the Bulgaria and thus calculating the average efficiency of the banking system over the period 2007-2015, we observe similar correlation between technical efficiency of the banking system and the economic growth in Bulgaria. Bank efficiency dramatically dropped in 2009 in the rise of the global financial crisis in Bulgaria, which reflected negatively on GDP growth - annual GDP growth in 2009 was - 3.6% (Figure 1).

Figure 1. Technical Efficiency and Economic Growth in Bulgaria in 2007-2015

Source: National Statistical Office, Eurostat, BNB, Own calculations

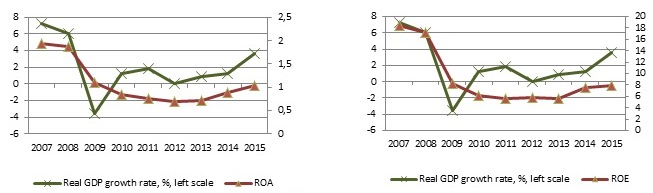

Using traditional performance indicators, such as return on assets and return on equity, we note that they did not follow fully the dynamics of GDP (Figure 2). Therefore it can be argued that traditional indicators cannot cover fully the activities of banks and take into account the changed situation of loans and deposits. This is particularly important especially in the context of the global financial crisis that mainly affects the banks in Bulgaria through reduction of foreign deposits from parent banks and the corresponding decline in loans to non-financial corporations and households.

Figure 2. ROA, ROE and Economic Growth in Bulgaria in 2007-2015

Source: National Statistical Office, Eurostat, BNB, Own calculations

The stronger relation between technical efficiency (TE), measured by the method DEA, and GDP growth (GDP), than the relation between GDP growth and traditional indicators (ROA and ROE), is confirmed by the higher correlation between the two variables in the first case (Table 1).

Table 1

Correlation Matrix

|

|

ROE

|

GDP

|

ROA

|

TE

|

|

ROE

|

1

|

0.756

|

0.993

|

0.271

|

|

GDP

|

0.756

|

1

|

0.723

|

0.798

|

|

ROA

|

0.993

|

0.723

|

1

|

0.221

|

|

TE

|

0.271

|

0.798

|

0.221

|

1

|

It can be concluded that for the purpose of analyzing the effectiveness of banks and estimating their intermediation role in the economy we should take into account non-traditional measures of performance, which provide accurate estimation of the intermediary role of banks, contributing to higher economic growth.

References

- Raykov, Е. (2012). Intercompany indebtedness – the missed market for the banks. 8th International Conference of Young Scientists "The economy of Bulgaria - challenges for macroeconomic policy, financial sector and real business", University of National and World Economy, Sofia, Bulgaria, 26 October 2012.

- Alin, A., Cocris, V. (2010). A Comperative analysis of the efficiency of Romanian banks. Romanian Journal of Economic Forecastiing, No 4.

- Sufian, F. (2010). Modeling banking sector efficiency: a DEA and time series approach. Economika, Vol. 89 (2).

[1] The assets of credit institutions as a share of GDP reached 101.3% at the end of 2015 versus only 34.5% in 2000.

[2] A production unit is technically efficient when it uses its inputs to produce outputs, which is located on the production frontier. The production frontier represents all points, giving the combination of the maximum outputs for given inputs of the production unit.

[3] Due to lack of official data about the employment by banks, alternative indicator is used - administrative costs of every bank for the period.

|